Quick links: What happens to complaints | July unemployment rate | Take the poll | Denver inflation | Horizon Organic adds B Corp | 100 Comcast RISE winners

Before Rohit Chopra stepped foot into the city of Westminster, the director of the U.S. Consumer Financial Protection Bureau said he did some research about local businesses.

He noticed that in the city, much like other cities across America, there were a lot of banks, grocery stores, pharmacies and other businesses linked to large corporate chains.

“Even here in Westminster,” Chopra said Thursday during an event hosted by the city, “it’s more and more banks that aren’t locally owned. And so the net result is that sometimes you go into a branch and there’s really no one who can actually help talk you through anything. You’re siphoned over to a 1-800 number or the person tells you to go online. And what happens is that everything is becoming a little bit more less-human.”

Chopra is trying to humanize our daily lives again by reducing the corporate callousness that can emerge with modern technology, like chatbots. As companies have grown larger through mergers and acquisitions, the effort to cut costs and increase profits has taken a toll on consumers and customer service. He’s especially interested in how banks and financial companies are treating people. As an independent agency inside the Federal Reserve, CFPB was a response to financial fraud that led to the Great Recession. Essentially, it enforces federal consumer protection law and keeps an eye out for financial mayhem that could hurt consumers.

During his stop in Colorado, Chopra talked a lot about junk fees and trying to rid the world of systems that might trick consumers into agreeing to them. He was joined by U.S. Reps. Brittany Pettersen and Yadira Caraveo and Colorado Attorney General Phil Weiser, who are in the same pursuit.

Chopra’s experience of contesting an issue with an airline ticket led him down an “endless loop” first with a chatbot and then through the airline’s phone system that transferred him from person to person.

“I think they want you to hang up,” he said to the audience. “They don’t want you to contest the fee or contest the problem. And I just think this is fundamentally wrong. There’s nothing more dehumanizing than being charged fees for fake or worthless services.”

The agency does get pushback. An effort to ban credit card late fees over $8 is now on hold after the U.S. banking industry opposed it. Prohibiting firms from charging new “convenience fees” to consumers paying off loans online or by phone, doesn’t mean companies abide by the law, causing CFPB to file an Amicus brief in support in such legal cases. Companies also don’t like that consumer complaints are published online and unvetted.

Got a problem? CFPB wants to know

But when consumers feel helpless, sometimes they don’t speak up. And now, there’s a federal agency that, he said, listens. On the online complaint page, CFPB says it sends companies about 25,000 complaints about financial products each week.

“When we get complaints at ConsumerFinance.gov, it doesn’t go into a black hole. We order the bank to reply to you and then we look into it,” Chopra said. “We also prioritize issues that we think could become a problem later. For example, we mentioned voice cloning, generative AI-related scams. … We’ll get six or seven complaints that sound exactly the same. And it turns out that 60,000 or 70,000 people have that problem.”

His other consumer tip? “If you’re in a dispute with a bank or a company, one of the things that often will get their attention is if you say to them or write to them, if you don’t solve this, I’m filing a complaint with the state AG or the CFPB,” he added. “Trust me, they will respond.”

In Colorado, Weiser said consumers can report scams, shady practices and other complaints at StopFraudColorado.gov. His team of lawyers and investigators don’t turn every complaint into a full-on court case but they look for trends. And sometimes, they’ll just send a letter to the accused company.

“We tend to look at either particularly egregious situations or patterns and sometimes we’re able to ask a few questions,” Weiser said. “And that actually does the trick.”

Resources:

➔ File a complaint about a financial product. The Consumer Financial Protection Bureau takes complaints online or by phone on any consumer-financial problem, including credit cards, debt collection, mortgages, loans and credit reports. The federal agency says that each week, it sends 25,000 complaints to companies for a response and most companies respond within 15 days. >> consumerfinance.gov/complaint or 855-411-2372

➔ File a complaint with Colorado AG. The state’s highest-ranked law enforcement officer is the AG and he works with local and federal agencies to investigate violations of consumer protection laws, antitrust and other legal issues. >> coag.gov/file-complaint (also in Spanish)

➔ More places to get problems resolved. Another official resource is via USA.Gov, which is part of the U.S. General Services Administration. This page has links to where consumers can complain about online purchases, company products or services, text scams and robocalls, car-related issues and more. >> usa.gov/consumer-complaints

July unemployment rate up a bit to 3.9%

In July, Colorado’s unemployment rate reached its highest level since January 2022. At 3.9%, it was up one-tenth of a percentage point from June. But even though this means more Coloradans were unemployed last month (up 1,844 to 126,270 who were looking for a job), the state’s labor force grew, too.

According to preliminary data, the state’s labor force is the largest it’s ever been, with 3,242,918 employed or looking for work. The changes in July, though, are pretty slight and are in line or better than how the nation is doing, said Tim Wonhof, an economist at the state Department of Labor and Employment

“Our population in Colorado has been growing consistently over time and our labor force has been growing consistently,” Wonhof said. “We, on the whole, are still at very low unemployment rates. Do we have a high number of discouraged workers? We have 126,000 people who are out of work and about a fifth of those, I believe, would fall into that category. But do we have more than usual now? I wouldn’t say we do.”

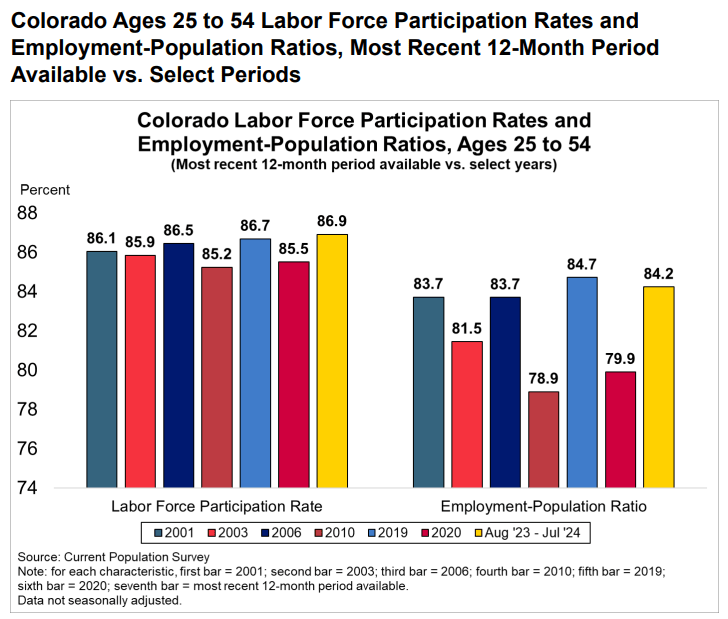

Wonhof pointed to a state labor department chart (below) that shows Coloradans between the working ages of 25 to 54 years old are part of the workforce more so than they’ve ever been in the past two decades.

The state also continues to add more jobs each month, adding 4,800 in July, he said. Nearly half were government jobs. For private industries, manufacturing lost 1,000 jobs, while trade, transportation and utility industries gained 4,100.

“Normally, our four-month average in Colorado would be a gain of 3,300 jobs. Well, we gained 4,800 (in July) so we’re ahead. At the national level, the four-month average is 154,000 and this month, they’re 114,000, so they’re a little bit down. But last month, it was the other way around,” Wonhof said. “I don’t read too much into the monthly numbers.”

Compared with the rest of the nation, Colorado was in the bottom half for unemployment rates, and ranked 31st. The U.S. unemployment rate for July was 4.3%.

>> See the data: Colorado’s July jobs report

Take the poll: How’s the economy treating you?

Denver led the way to lower inflation in July. Did you notice? Take the reader poll to help us report on Colorado’s economy: cosun.co/WWCOeconomy2024

Updates on big Colorado economy news

We reported on these stories earlier this week but there have been some updates. Keep reading.

➔ Denver-area inflation rate down to 1.9% in July. Prices are still rising, but inflation fell to its lowest 12-month increase in three years in Denver. That drop to a 1.9% inflation rate surprised a few local economists, especially since the U.S. rate is still at 2.9%, which was also the lowest in three years. So what’s causing the decline in Denver’s Consumer Price Index?

Prices here have fallen for some items, like gas, apparel and new and used cars. Grocery prices didn’t change at all. But other items continued to increase, including dining out, up 5.7%. Shelter was up 2.1%, and that’s a huge chunk of a consumer’s budget. Keep in mind, the official rate considers just the one-year change, not how much groceries cost today compared to five years ago. But yes, prices are much higher than five years ago.

Denver’s rate was also the lowest nationwide. But the Denver data appeared to be missing some key data points, like the change to costs of electricity and natural gas. I reached out to the Bureau of Labor Statistics to ask why and, essentially, they said they didn’t get enough responses. When there’s not enough, they don’t release the data, as in the case of the Denver energy index.

“The missing items will still impact the aggregate indexes they belong to,” said Justin Copple, a BLS spokesman. “The prices that were successfully collected are used to calculate an unpublishable CPI which is used to aggregate up to the larger expenditure categories all the way through to all items less food and energy and all items.”

Other items, like automobile insurance, have been removed entirely from Denver’s data. Auto insurance in Denver hasn’t been tracked since 2021. BLS officials said that, too, could be linked to low responses. In those cases, Denver’s auto insurance calculation would default to the national urban CPI, which was 18.6% higher in July.

>> Earlier: Denver inflation slowed faster than the national rate to 1.9%. Does it feel like it?

➔ New business filings dropped 21.7%. During her quarterly update on how many businesses there are in Colorado, Secretary of State Jena Griswold said the rate of new filings dropped 21.7% in the second quarter, compared with a year earlier. Griswold attributed the decline to the end of a big discount around June 2023 that dropped filing fees to $1.

But there were other concerns about the data, including the growing number of delinquent filers. As reported earlier, delinquencies grew 91,000 in the quarter and now number more than 934,000. The Secretary of State’s Office said that the list includes years of businesses that never officially dissolved and it also includes owners who may be just a few weeks late in renewing their paperwork. I wondered how late? Here’s additional information, which I’ll track in future new business updates.

Of those 934,437 delinquent filings in the second quarter, here’s how late they were as of Aug. 14, according to the Secretary of State’s Office.

>> Earlier: Number of new Colorado businesses drops 21.7% nearly a year after filing-fee discount ends

Sun economy stories you may have missed

➔ Colorado food banks may soon run out of the federal funds they use to buy local produce. Colorado received close to $10 million in pandemic-era funding to help food banks buy local produce, but the money is running low with no replacement in sight >> Read story

➔ Colorado governor calls special session on property taxes to avoid ballot measure fight in November. The special session will allow lawmakers to advance a deal under which the conservative supporters of Initiatives 50 and 108 will pull their measures from the ballot >> Read story

➔ With rising rents, theater companies are renting a Denver office space to rehearse. The new Three Leaches Theatre on Colfax will house two theater companies and a gallery, and hopes to lessen the burden on the few affordable rehearsal spaces left in Denver >> Read story

➔ The economics of eating out have some of Denver’s top chefs dismayed, discouraged and looking elsewhere. Some of the city’s award-winning chefs get specific about their love/hate relationship of being part of Colorado’s largest dining scene >> Read story

➔ Geothermal developers to get $1M from Icelandic investors, energy office to tap resource deep under Chaffee County. Investors will match a $500,000 grant from the Colorado Energy Office, which Mt. Princeton Geothermal will put toward testing its well site near Buena Vista >> Read story

Show your support for local reporting. Donate to The Sun!

Other working bits

➔ Horizon Organic becomes a B Corp (again). The Broomfield dairy brand has provided organic milk since 1991. But only last month did it receive B Corp Certification, a designation that the for-profit company has met stringent tests and is deemed beneficial to all stakeholders, which includes employees, suppliers and the community. That’s the same with sister company Wallaby, which makes Greek yogurt. So, why only now? It had to reapply after its former parent, Danone sold the brands to Platinum Equity in April. Danone is one of the world’s largest B Corps.

“Following the acquisition,” said Tyler Holm, CEO of the two brands, in an email, “it was important to pursue independent B Corp certification to demonstrate an ongoing commitment to redefining success in business as a force for good. As a result, all Horizon Organic and Wallaby products will continue to carry the B Corp seal.”

Certified by the B Lab organization, companies must pass tests that score what their value and benefits are as a business, to the environment and the community. >> Horizon’s B Corp score

➔ Cost of health insurance is top challenge for small businesses. This shouldn’t be a surprise for members of the National Federation of Independent Business, which advocates for small business owners. Health insurance has been the top issue since 1986, according to the organization, which published its 2024 report called “Small Business Programs & Priorities.” Top Colorado-specific issues weren’t available, said state director Tony Gagliardi but “the threat of a massive federal tax hike in 2025 exacerbates the uncertainty Main Street Coloradans are feeling,” he said in a news release. He’s pushing for Congress to make the 20% Small Business Deduction permanent. >> Read report

➔ Comcast awards 100 southern Colorado companies a 30-second commercial and $5,000. The state’s dominant cable TV provider unveiled winners of its RISE awards, which isn’t an acronym but a program that launched in 2020 to support minority-owned small businesses impacted by the pandemic. The 100 winners in Colorado are all in the southern half of the state and include RAD Hostel in Colorado Springs, The Walter Brewing Company in Pueblo and Armadillo Ranch in Manitou Springs.

Comcast focused on southern Colorado because of the growth in small businesses which “account for over 90% of total employment,” said Wendy Artman, a Comcast spokesperson. “This is an area where this program can make a big difference.”

Recipients receive $5,000, a tech makeover and a fully produced TV commercial (from Comcast’s advertising sales division Effectv) that will air on local cable channels. >> The winners

Got some economic news or business bits Coloradans should know? Tell us: cosun.co/heyww

Thanks for sticking with me for this week’s report. Remember to check out The Sun’s daily coverage online. As always, share your 2 cents on how the economy is keeping you down or helping you up at cosun.co/heyww. ~ tamara

Miss a column? Catch up:

What’s Working is a Colorado Sun column about surviving in today’s economy. Email tamara@coloradosun.com with stories, tips or questions. Read the archive, ask a question at cosun.co/heyww and don’t miss the next one by signing up at coloradosun.com/getww.

Support this free newsletter and become a Colorado Sun member: coloradosun.com/join

The Colorado Sun is part of The Trust Project. Read our policies.

Corrections & Clarifications

Notice something wrong? The Colorado Sun has an ethical responsibility to fix all factual errors. Request a correction by emailing corrections@coloradosun.com.